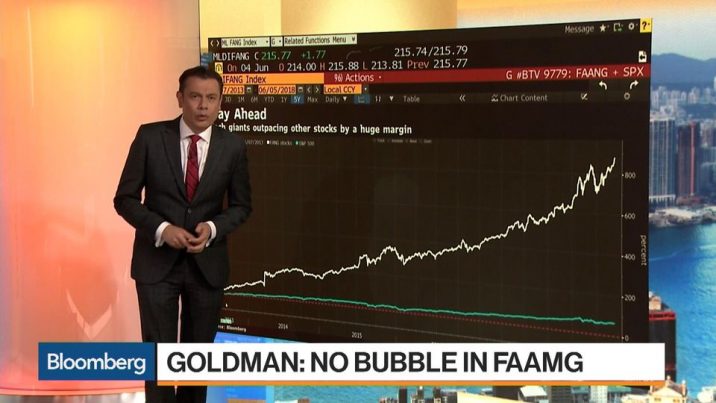

Stocks of Facebook, Amazon, Apple, Microsoft and Google’s parent, Alphabet (a.k.a. the “FAAMG” stocks), have run up in recent years, with a few of the tech behemoths close to becoming the world’s first trillion-dollar company.

Currently, the total value of FAAMG stocks is greater than Germany’s annual economic output. Beeindruckend!

Some investors are worried that tech stocks have increased too much, too soon, and that the “bubble” could burst, sending valuations spiraling downwards like in the early 2000s – when some investors lost up to 80% of their cash.

In a note to investors, Goldman Sachs said it doesn’t believe there’s a bubble in tech stocks. A key difference compared to the early 2000s is that 90% of the shares’ rise is explained by profit growth at these companies (in the dotcom bubble, tech companies weren’t making profits so investors were largely buying in the hope of profit on the horizon).

Goldman’s analysts also said that tech companies only represent about a quarter of the US market right now – and as sectors ranging from retail to finance increase spending on technology, there’s plenty of room for tech stocks to continue to grow for the next decade and beyond.

Past performance is not an indication of future results. Also, leveraged products can carry a high degree of risk. eToro offers protective measures to manage risk effectively, but in rare occasions it is possible to lose more money than invested. This content is for information and educational purposes only and should not be considered investment advice nor portfolio management.

Tags: Alphabet, Amazon, Apple, bubble, etoro.com, FAAMG, facebook, Goldman Sachs, Microsoft, stocks