IQ Option can boast an abundance of equity-based products — the list of companies, available in the CFD section, is over 140. Of course, in order to trade them successfully you’ll need to know how to evaluate a company. Read this article to be able to buy with a discount and sell at a premium.

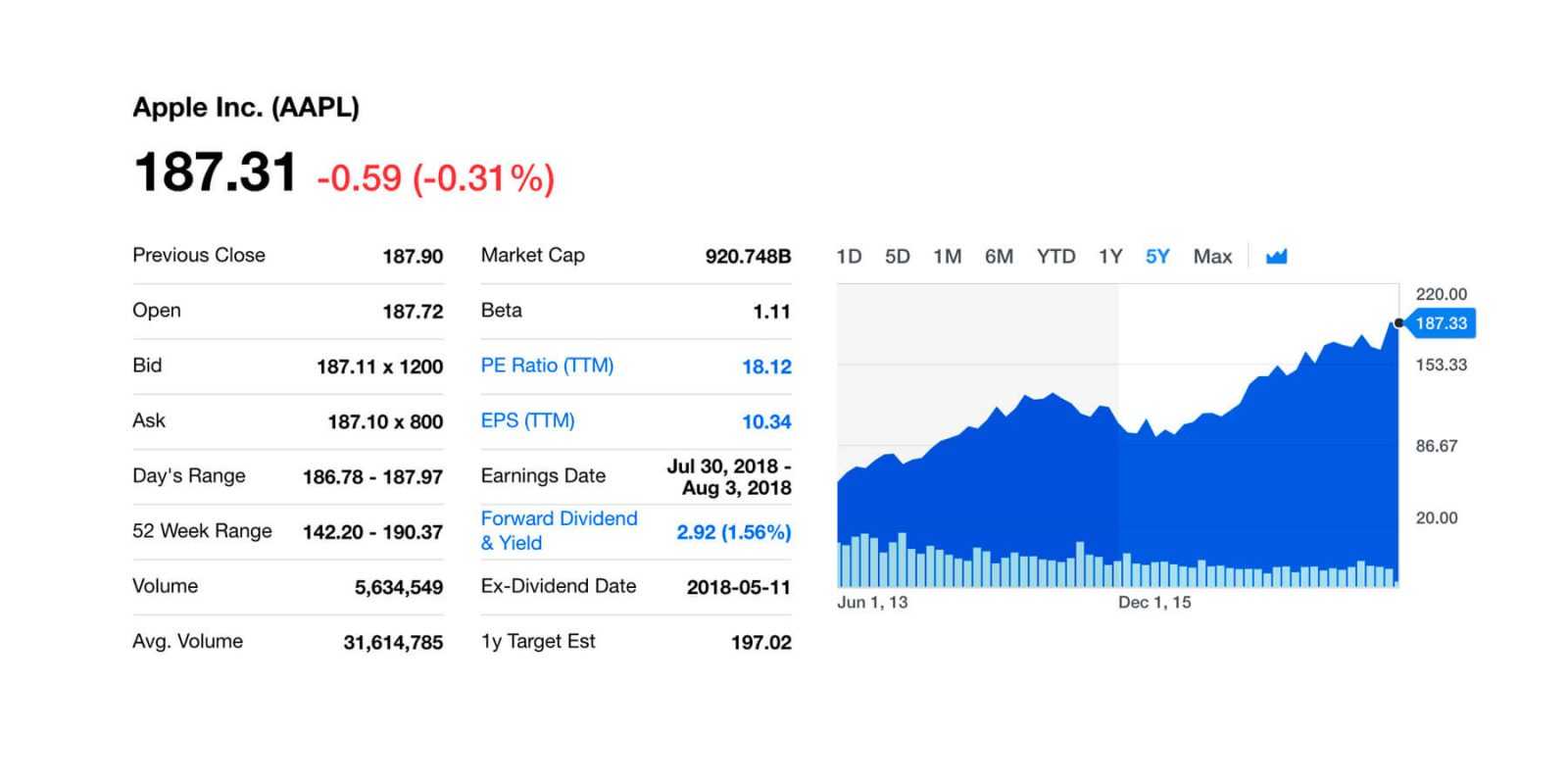

Earnings Per Share (EPS)

Commercial companies are created with the sole purpose of making money. The more the better. Not being able to meet the expectations of financial experts and investors in terms of earnings puts a company at a disadvantage. The rest of the market is less likely to trust them with money and the stock price can be expected to go down.

If the company demonstrates stagnation or — even worse — negative dynamics in earnings per share it is probably not worth your investment. Companies with growing earnings per share, on the other hand, deserve your attention and should be treated as investment opportunities.

Price-to-Earnings Ratio (P/E)

Earnings per se are not that helpful when comparing two or more companies. Say, company A has $1 million in earnings, its share is worth $100. Company B, in turn, can only boast $500 000 in earnings. However, its share is traded at $25. Judging by this metric alone, a lot of value investors would prefer company B to company A. Earnings per share is what you get, the price is what you pay. In other words, you want to buy a company with high enough earnings and reasonably low market price.

A lot of big international companies, especially in the high-tech industry, have unreasonably high P/E ratios. The latter does not automatically translate into an ‘avoid-at-all-cost’ label. Suchlike companies are still capable of demonstrating decent (sometimes quite impressive) growth, yet they are less attractive to a value investor.

The PEG Ratio

The PEG Ratio

For most investors, P/E Ratio and Earnings Per Share are not enough to draw a conclusion. After all, your money is at stake. Price to Earnings Growth ratio, that can hint at a probability of higher reward in the future, is used to evaluate a company over a period of several years. If the ratio is going down over time, it is a good sign. The former would mean that the company is either demonstrating an increase in earnings or a decrease in market price. When the P/E is going up, the investment becomes less appealing.

Remember that companies can go up in price without demonstrating any substantial increase in earnings. Still, in the long run it is earnings that fuel the market capitalization of a publicly traded enterprise.

Dividend Yield

Stock is not only good because it can grow in price. Dividend payments should not be discarded, as well. Dividend Yield is received by dividing the annual dividend by the stock price. In other words, it can be treated as an interest on your money. Dividends, however, are a tricky subject, as it is not always beneficial for the company to distribute the profit among shareholders. Sometimes it is worth to reinvest the money in the further development of the company, so keep that in mind.

All above-mentioned metrics can be found in or derived from earnings reports, posted by companies on their corporate websites. Now, when you know how to evaluate a company like Warren Buffett, find a company to analyze and invest in.

NOTE: This article is not an investment advice. Any references to historical price movements or levels is informational and based on external analysis and we do not warranty that any such movements or levels are likely to reoccur in the future

GENERAL RISK WARNING

The financial services provided by this website carry a high level of risk and can result in the loss of all your funds. You should never invest money that you cannot afford to lose.

Tags: etoro.com, iqoption.com, stocks