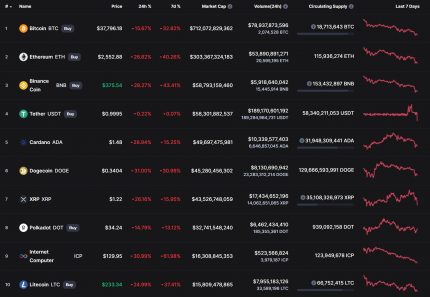

Digital currency prices have been highly correlated with bitcoin, the first half of 2018. That will be coming to an end, as markets begin to understand the differences between cryptocurrencies and their use cases, says Ripple CEO, Brad Garlinghouse.

- Invest in crypto – https://bit.ly/2WIGIklor https://goo.gl/k1jplg

- Make a cryptocurrency wallet – https://bit.ly/304BqkWor https://bit.ly/2G0bMH7

- Buy with credit card – https://goo.gl/qoHJV7or https://bit.ly/2FXN0Hv

- Exchange – https://bit.ly/38Zy4UK, or https://bit.ly/2WGLi2B

“It’s early, over time you’ll see a more rational market and behaviors that reflect that,”Garlinghouse says.

“There’s a very high correlation between the price of XRP and the price of bitcoin, but ultimately these are independent open-sourced technologies,” Garlinghouse added. “It’s early, over time you’ll see a more rational market and behaviors that reflect that.”

Ripple develops a network for faster global financial payments, while XRP is the name of the digital token that financial institutions on the network can use to transact quickly.

The company itself had a record first quarter, signing 20 production contracts with new firms, Garlinghouse said. Yet in that same time period, XRP lost 70% of its value and was the worst performer among the top digital currencies.

“It’s still a nascent industry, the speculation in the market dominates the trading activity,” Garlinghouse said. “I think it’s a matter of time until people better understand the different use cases.”

NOTE: This article is not an investment advice. Any references to historical price movements or levels is informational and based on external analysis and we do not warranty that any such movements or levels are likely to reoccur in the future

GENERAL RISK WARNING

The financial services provided by this website carry a high level of risk and can result in the loss of all your funds. You should never invest money that you cannot afford to lose.

Past performance is not an indication of future results. Also, leveraged products can carry a high degree of risk. eToro offers protective measures to manage risk effectively, but in rare occasions it is possible to lose more money than invested. This content is for information and educational purposes only and should not be considered investment advice nor portfolio management.